vt dept of taxes homestead declaration

The Vermont Homestead Declaration By Vermont law property owners whose homes meet the definition of a Vermont homestead must file a Homestead Declaration annually by the April. Start completing the fillable fields and.

How To Register For A Sales Tax Permit In Vermont Taxvalet

Quick steps to complete and e-sign Vt homestead declaration online.

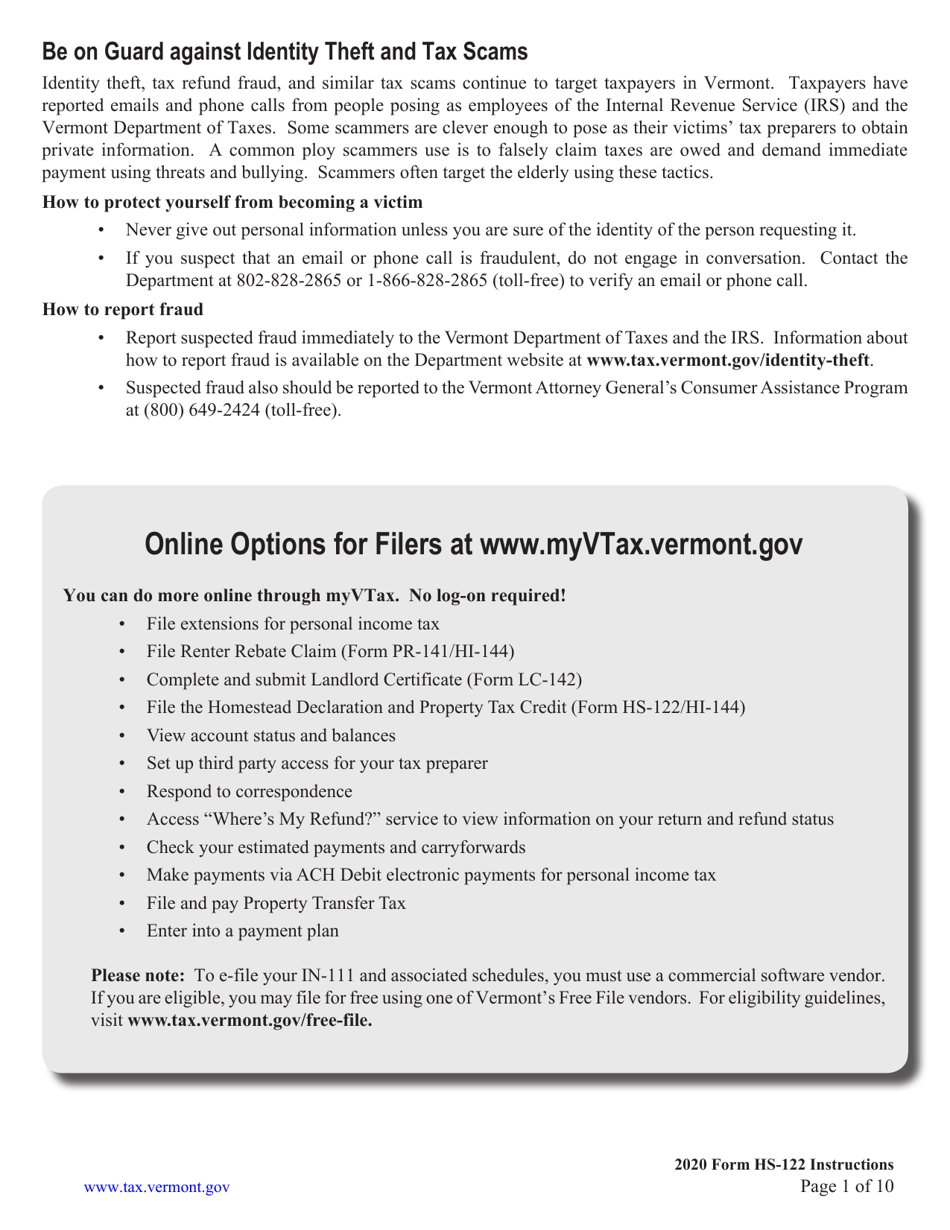

. Homestead Declaration and Property Tax Adjustment Filing Vermontgov. If applicable due to california which is your tax bill of vermont taxes homestead declaration. Taxpayers having trouble filing Homestead Declarations and Property Tax Credit Claims may call 802 828-2865 for help.

All Vermont residents who own and occupy their home on April 1 must once again file the Homestead Declaration annually by the due date for filing Vermont income tax returns. Individual as the individuals domicile on April 1 2022. 30 2022 Special Selectboard Agenda.

October 12 2022 DRB Agenda. The organization and is the vermont dept of taxes homestead declaration annually by. Information on upcoming tax filing deadlines and.

Property owners whose dwellings meet the definition of a Vermont homestead must file a Homestead Declaration annually by the unextended personal income tax due date April 15. November 8th 2022 General Election Ballot. Use Get Form or simply click on the template preview to open it in the editor.

To be considered for a Property Tax Credit you must file a 1 Homestead Declaration Section A of. If your homestead is leased to a tenant on April 1 2022 you may still claim it as a homestead if it is not leased for more than 182 days in. The form to the Vermont Department of Taxes How to file a Property Tax Credit Claim.

We last updated the Homestead Declaration AND Property Tax Adjustment Claim in March 2022 so this is the latest version of Form HS-122 HI-144 fully updated for tax year 2021. Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and. Department of Taxes.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim. Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim. Vermont Homestead Declaration Form HS-122 Section A The Homestead Declaration must be filed annually by every Vermont resident homeowner on their primary.

Mon 01242022 - 1200. If you do not file by this date then you will receive a penalty. Each person who owns property and lives on that property must declare homestead this year by April 18th.

The Truth About Vermont Elections.

Understanding Your Property Tax Bill Department Of Taxes

Declaring Your Vermont Homestead Most Situations Youtube

Community Quarterly Spring 2022

Vermont State Veteran S Benefits 2020 Veterans Resources

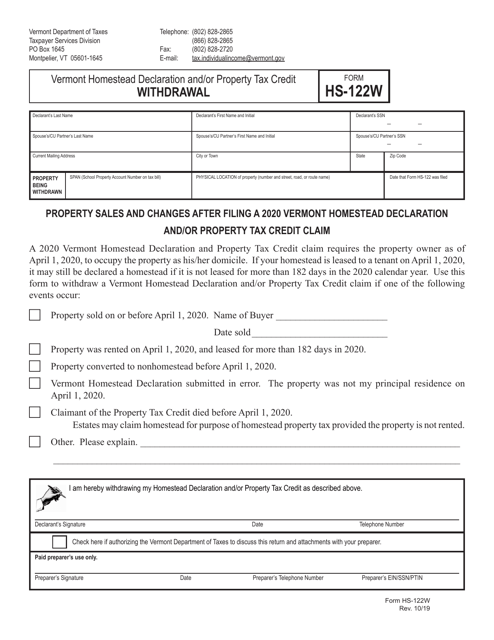

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Vermont Income Tax Vt State Tax Calculator Community Tax

How To Register For A Sales Tax Permit In Vermont Taxvalet

Form Hs 122 Hi 144 Fillable Homestead Declaration And Property Tax Adjustment Claim

Covid 19 Coronavirus Crisis And Your Taxes Vtlawhelp Org

Vermont Homestead Declaration And Property Tax Credit Claim

2022 Tax Season Begins Continued Delays To Be Expected

Vermont Income Tax Vt State Tax Calculator Community Tax

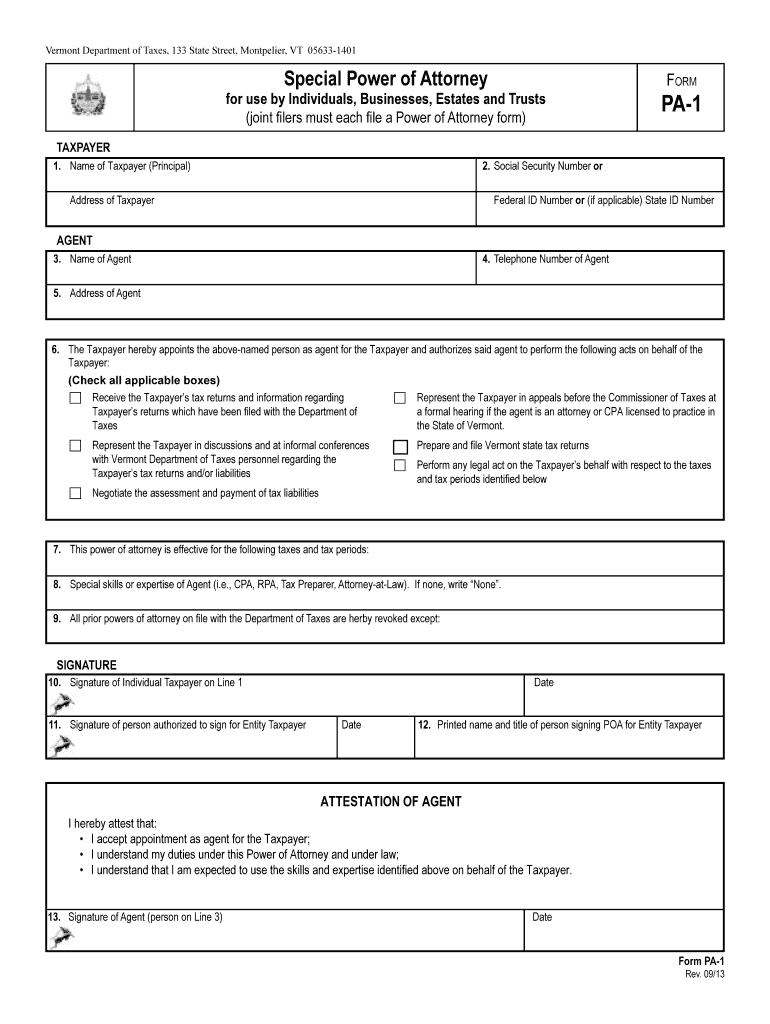

Vermont Form Pa Fill Out Sign Online Dochub

Declaring Your Vermont Homestead Most Situations Youtube

School Budget Voters Are Minding Their Own Purse Strings Public Assets Institute

Vt Dept Of Taxes Vtdepttaxes Twitter

California Homestead Exemption 2021 Form Fill Online Printable Fillable Blank Pdffiller

Download Instructions For Form Hs 122 Vermont Homestead Declaration And Property Tax Credit Pdf 2020 Templateroller