does nh tax food

NH imposes a 9 percent tax on meals and rooms with a 3 percent vendor discount. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax.

.png)

States Sales Taxes On Software Tax Foundation

The State of New Hampshire does not issue Meals and Rooms Rentals Tax exempt certificates.

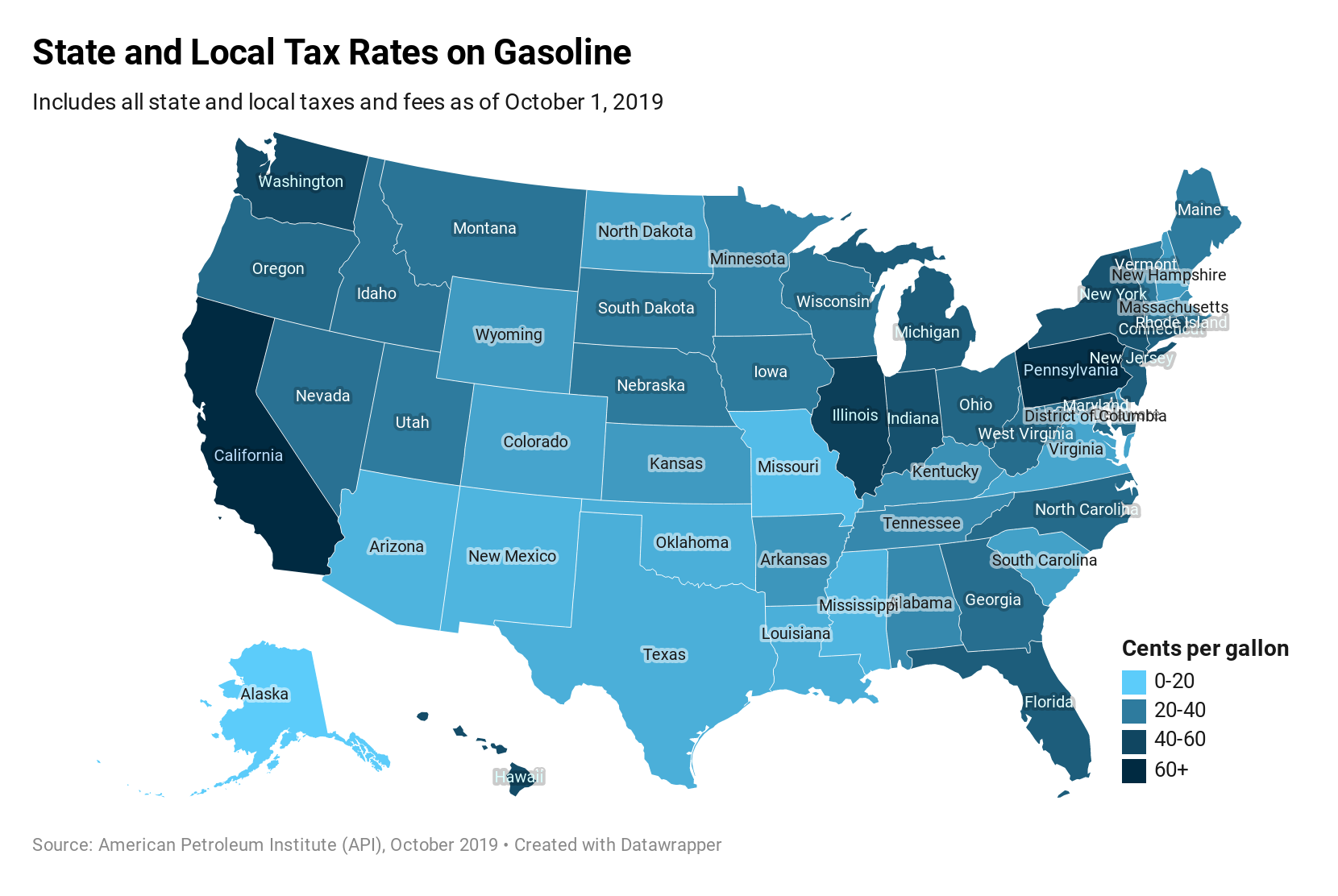

. 0183 per gallon. No inheritance or estate taxes. In the state of maine there is an exemption for food products which was intended for home consumption although this exemption is limited specifically to.

Liquefied Natural Gas LNG 0243 per gallon. There have been important changes to the Child Tax Credit that will help many families receive advance payments. Prepared Food is subject to special sales tax rates under New Hampshire law.

Virginia Sales of prepared foods are generally taxable in Virginia. New Hampshire does not have a sales tax but it does have a number of sin taxes. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations.

New Hampshire is one of the few states with no statewide sales tax. Its 9 on sales of prepared and restaurant meals and 10 on alcoholic beverages served in restaurants. A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency.

New Hampshire does not levy an estate tax although residents are liable for the federal estate tax. The table below summarizes the estate tax rates for New. New Hampshire does not exempt any types of purchase from the state sales tax.

Sales tax rate Exemption status Food Prescription drugs Nonprescription drugs New Hampshire. New Hampshire Beer Tax 21st highest beer tax. Does Nh Have Food Tax.

The tax is 625 of the sales price of the meal. Accordingly New Hampshire is listed as NA with footnote 11. Does nh tax food.

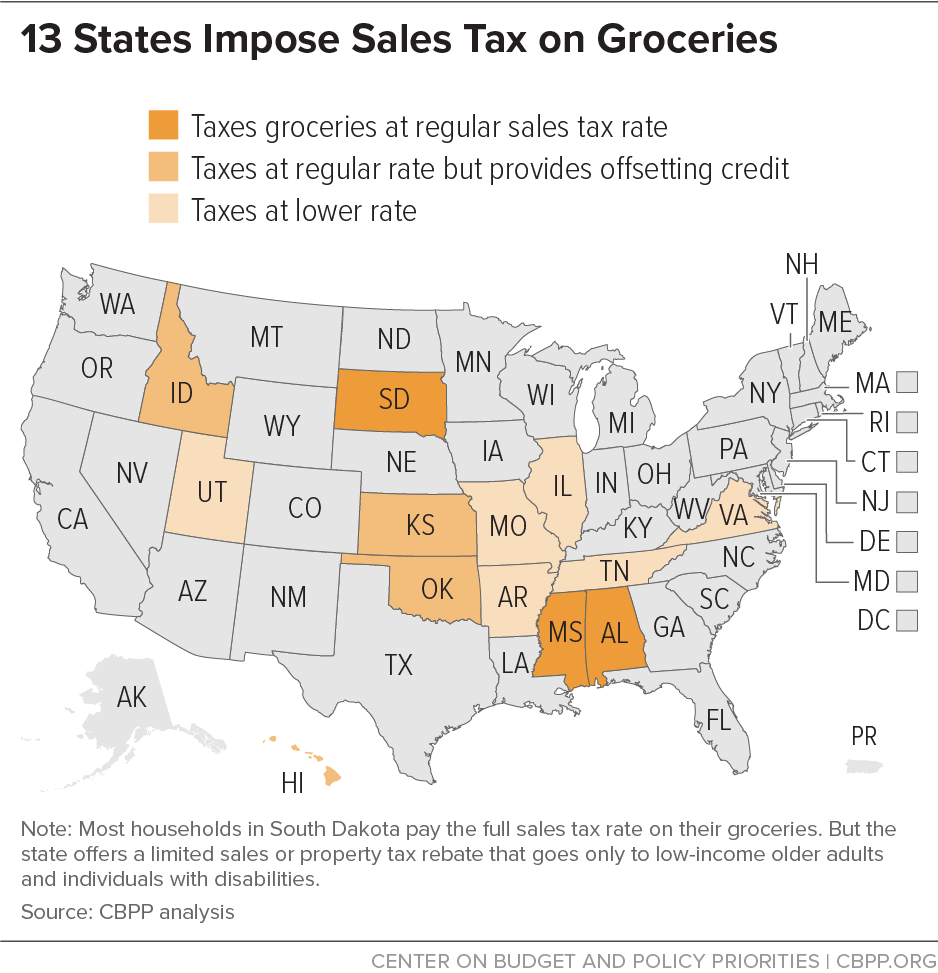

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. How should I handle coupon and discount sales. California 1 Utah 125 and Virginia 1.

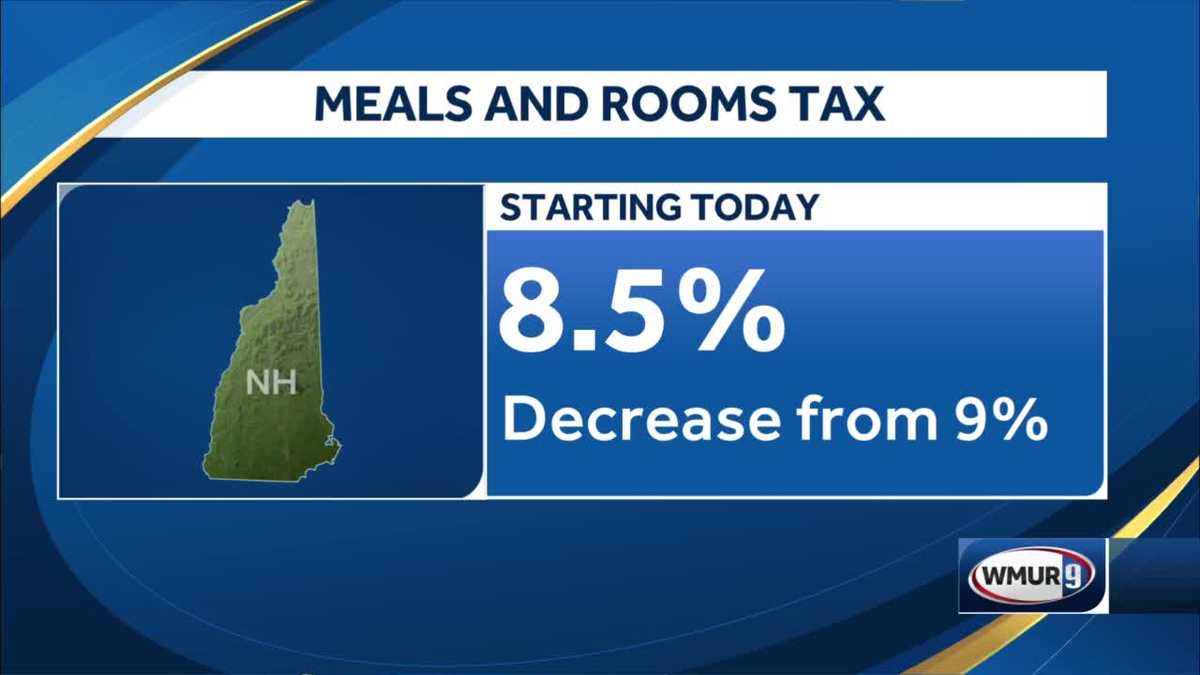

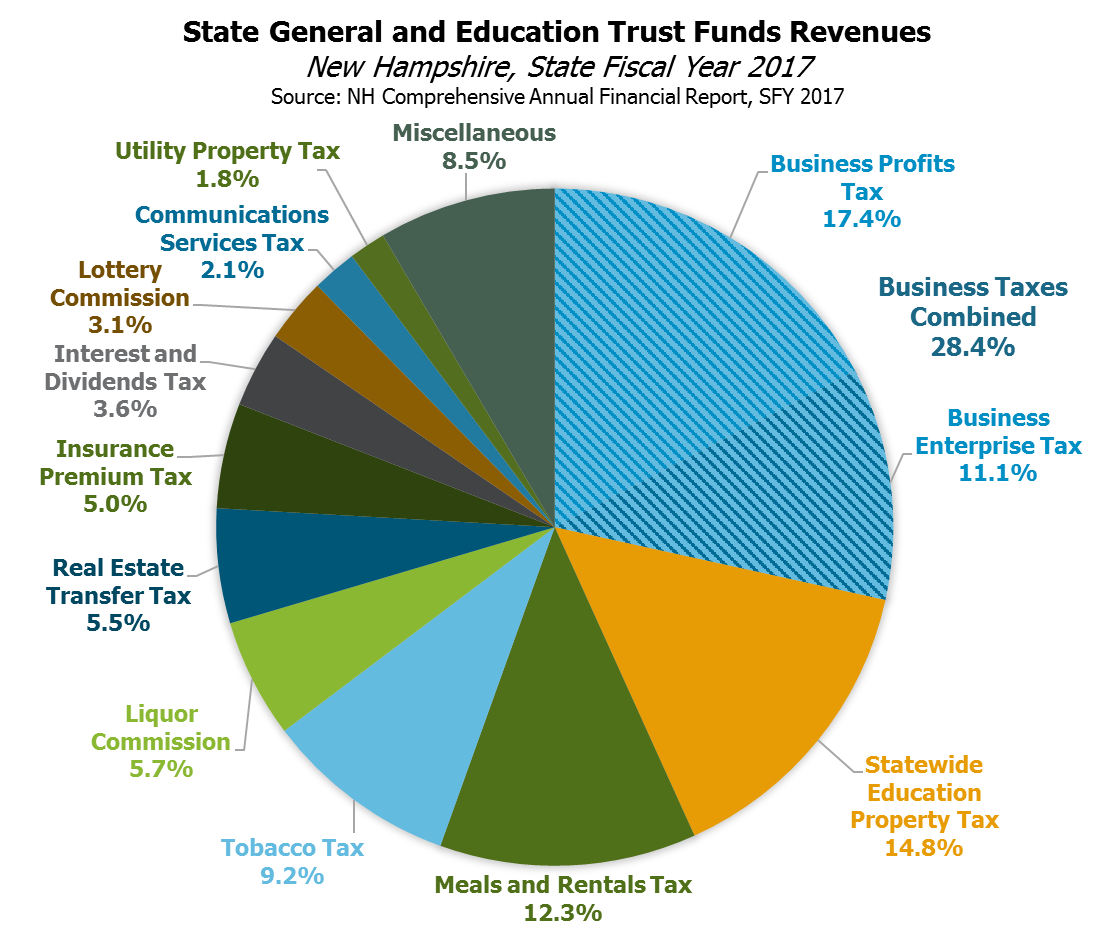

New Hampshire does collect. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services. Please note that effective october 1 2021 the meals rentals tax rate is reduced from 9.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Part of the answer lies in the nature of New Hampshires. New Hampshire Guidance on Food Taxability Released.

No capital gains tax. If you have any questions about tax exempt sales please call the Department for clarification at 603 230-5920. The tax should be applied to the sale amount after the discount or coupon reduction has been taken.

No state sales tax Maine. If you are an Able-bodied Adult Without Dependants ABAWD work rules have been suspended from 10-01-2021 through 09-30-2022. The Granite States low tax burden is a result of.

No state sales tax. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. The New Hampshire excise tax on beer is 030 per gallon higher then 58 of the other 50 states.

The answer was New Hampshire has such an antiquated tax system with the property tax that there is no money to meet needs in communities that have to be funded through the state. No state sales tax. A 9 tax is also assessed on motor vehicle rentals.

Federal excise tax rates on various motor fuel products are as follows. Read more about the Vermont Meals Rooms tax here. Alcohol sales also provide significant revenue to the state because you can only purchase liquor in New Hampshire at a state-run store.

The tax is 625 of the sales price of the meal. The New Hampshire beer tax is already added to the purchase price of all beer bought in New Hampshire whether in kegs bottles or cans. Food prepared on the premises as defined in Rev 70116 which could reasonably be perceived as competing with an eating establishment that.

The state has a cigarette tax of 178 per 20-pack of cigarettes and a beer tax of 30 cents per gallon. New Hampshire has a long history of Yankee frugality that has served us well and is supported by people across party lines. We include these in their state sales tax.

New Hampshires beer excise tax is ranked 21 out of the 50 states. There are however several specific taxes levied on particular services or products. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. Twenty-eight states allow vendor discounts most with caps of 25 to 500 per month. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire FoodBeverage Tax.

An essential part of. It lists information on general sales taxes. B Three states levy mandatory statewide local add-on sales taxes.

New hampshire rules vary greatly from federal laws and include the business profits tax business enterprise tax and rooms and meals tax. In most states necessities such as groceries clothes and drugs are exempted from the. 53 rows Table 1.

Technical information release provides immediate information regarding tax laws focused physical areas of grocery stores convenient stores and gas stations. Vermont Vermont has something called the Meals Rooms tax that applies to prepared foods. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

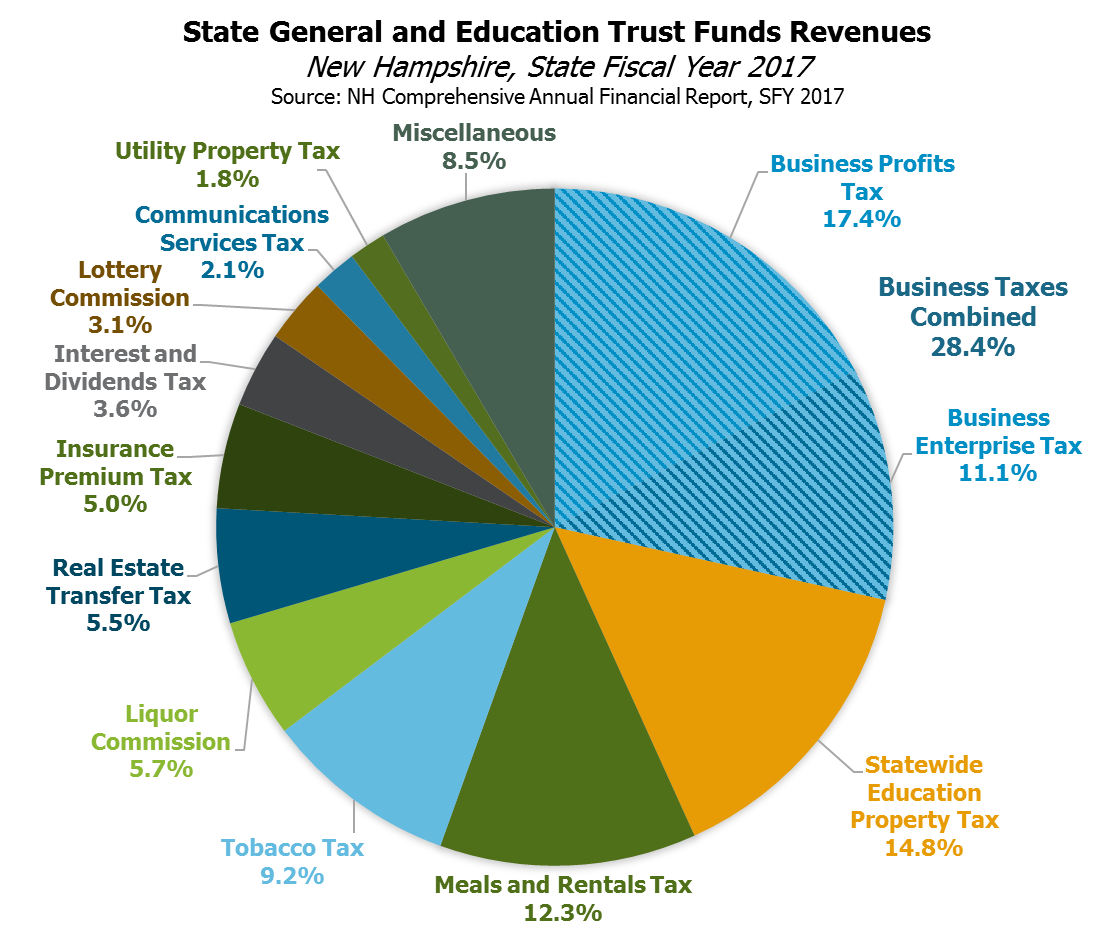

All of which raises the issue of why New Hampshire has no income or other broad-based tax. Property taxes that vary by town. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions.

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax On Grocery Items Taxjar

The Most And Least Tax Friendly Us States

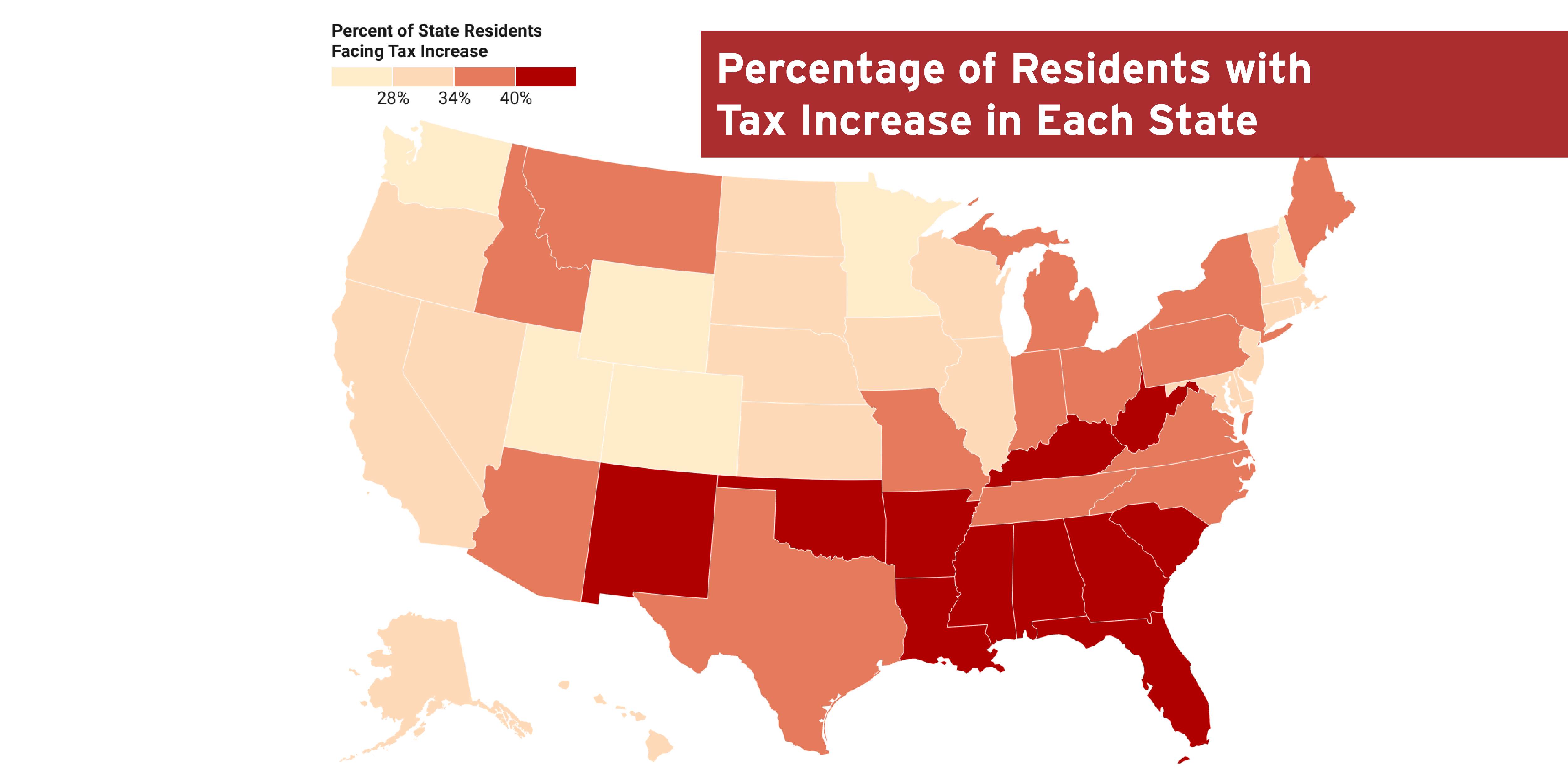

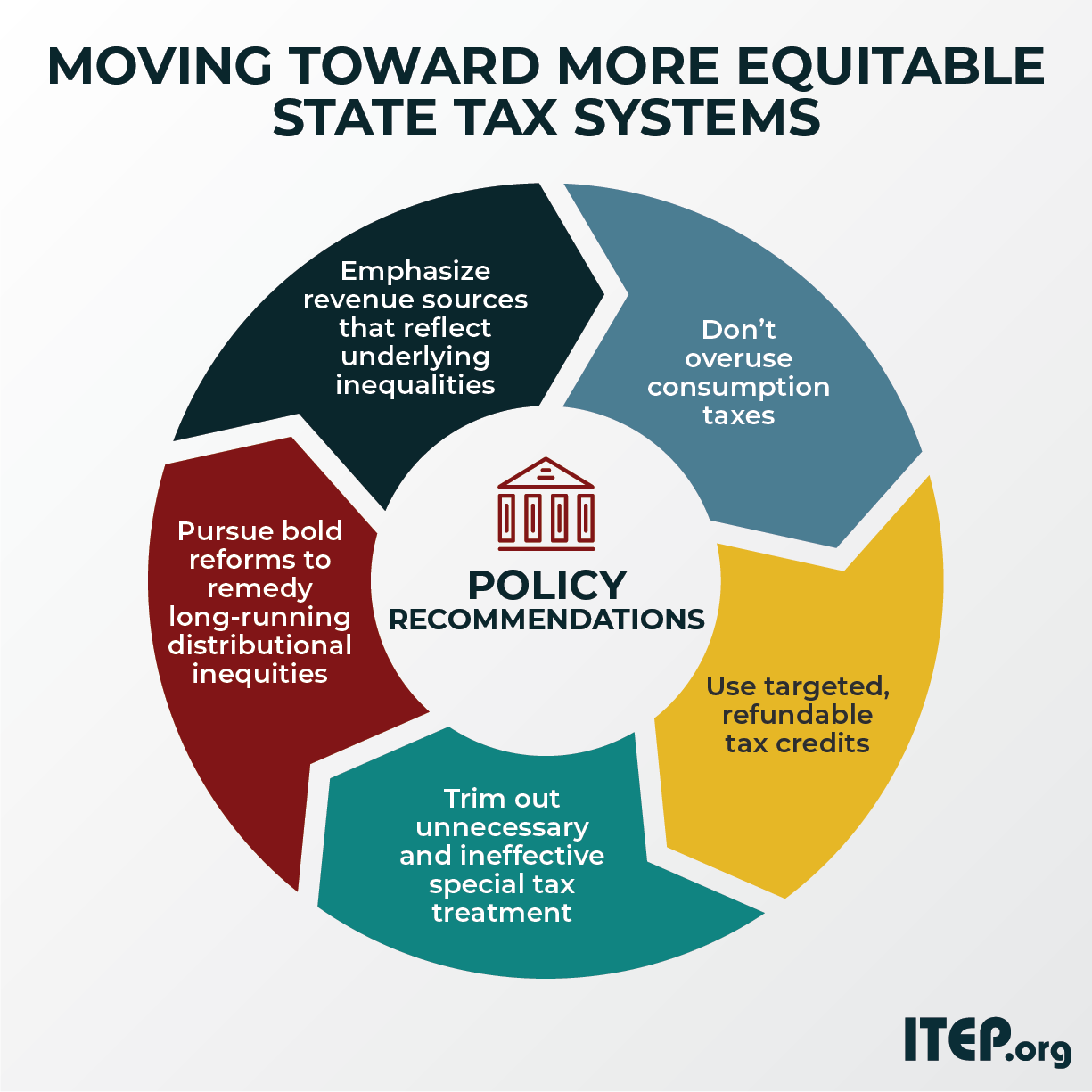

Moving Toward More Equitable State Tax Systems Itep

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

How To Register For A Sales Tax Permit Taxjar

/US_states_by_GDP_per_capita_nominal-f89d1ca278a649a9b47e858ee41e7f09.png)

Cost Of Living In Texas Vs California What S The Difference

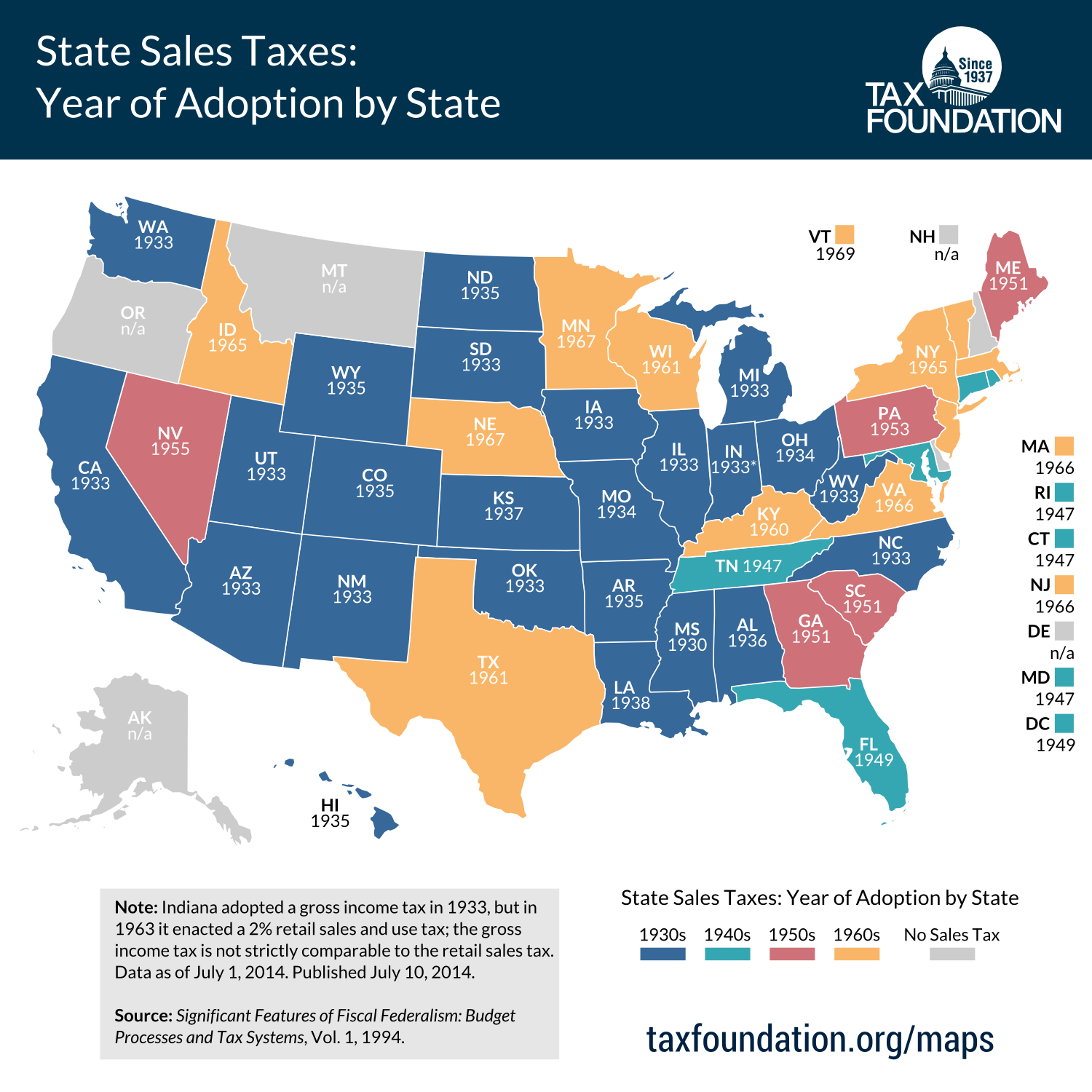

When Did Your State Adopt Its Sales Tax Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

States With Highest And Lowest Sales Tax Rates

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times